Author: Choivo Capital  | Publish date: Sun, 10 May 2020, 11:41 AM

| Publish date: Sun, 10 May 2020, 11:41 AM

For a copy with better formatting, go here, its alot easier on the eyes.

Hot Potatoes (Hidden Structural Risks in Insurance Companies and Banks)

========================================================================

Here is an interesting statistic.

Across the world, out of the 196 countries in the world, only around 50 or less countries run a budget surplus or balanced budget, ie the country's revenue exceed/equal its expenses consistently.

The rest of the world runs on a deficit and needs to borrow money in order to cover the shortfall in government revenue.

And out of the 50 or less countries that balance their budgets or have surpluses, the significant economies (large enough) are,

Macau

Hong Kong

Norway

Singapore

Jamaica

South Korea

Sweden

Iceland

Bulgaria

New Zealand

Germany

Berlarus

Luxembourg

Netherlands

Czechia

Uzbekistan

Switzerland

Taiwan

Combined, these countries barely consist of 10% of global GDP. In addition, their total surpluses also does not exceed even 3% of the total deficits of the rest of the countries.

And thus the question, who are the ones borrowing money to these countries?

Enabling them spend far beyond their means, and allowing huge fixed costs to build up in economies around the world.

Well, allow me to introduce you to "Basel III" (New Regulation for Banks since 2009) and "Solvency II" (New Regulations for Insurance Companies since 2009).

Both of these two regulations were given rise via directives from the European Union after the 2008 Great Financial Crisis and subsequently adopted worldwide.

Banks (Basel III)

For banks, Under the new Basel III regulations, there is something called the Liquidity Coverage Ratio, which requires banks to maintain lots of very safe liquid assets like government bonds to cover funding stress.

This ratio also categorizes certain deposits as “non‐operating” and assigns them punitive haircuts when calculating the ratio.

These deposits include deposits received from the retail market, Which includes fixed deposits or current accounts placed by individuals or companies.

In response to these regulations, banks are therefore incentivized to purchase and hold sovereign debt sold by all these countries running fiscal deficits, while looking for loopholes enabling them to more profitably carry these non‐operating deposits.

These methods include:

Asking customers to switch unwanted deposits into sovereign bonds the bank can hold in custody

Asking customers to take out loans to buy sovereign bonds and replace the cash.

Asking customers to transact through off‐balance sheet derivatives such as

swaps

Asking customers to replace physical cash positions with synthetic look‐alikes, collateralized with sovereign bonds.

All of which drives up the demand for sovereign bonds.

Insurance Companies (Solvency II)

The Insurance Companies are also under a similar situation when it comes to their Portfolio they hold and the Capital Charges/Haircuts required for each asset class in order to calculate Solvency Ratios.

Now, its probably not that easy to imagine the above scenarios, so lets put some numbers to it.

Illustrating Distortions cased by Basel III and Solvency II

Imagine a Bank/Insurance Company, lets call it "Baka-Surance Bank".

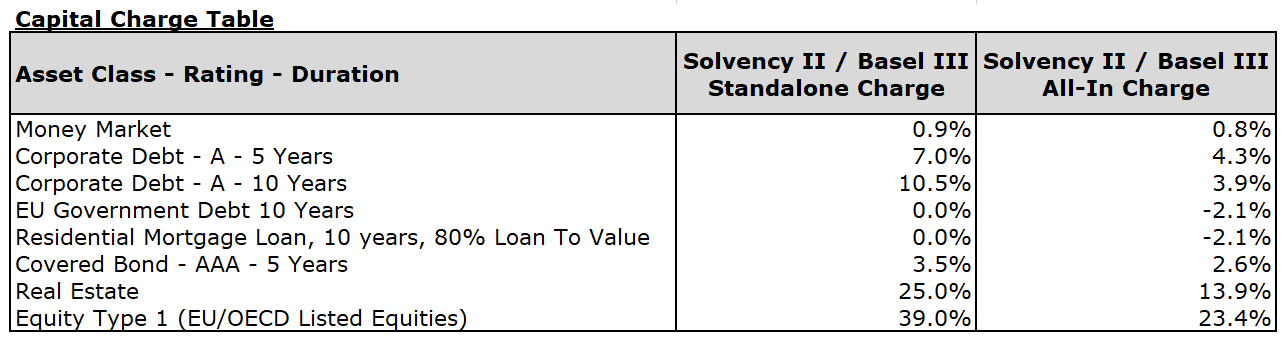

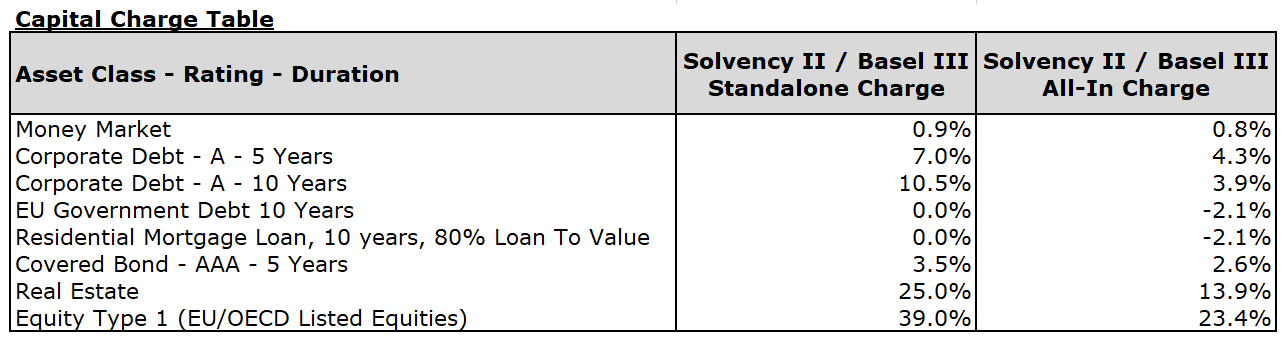

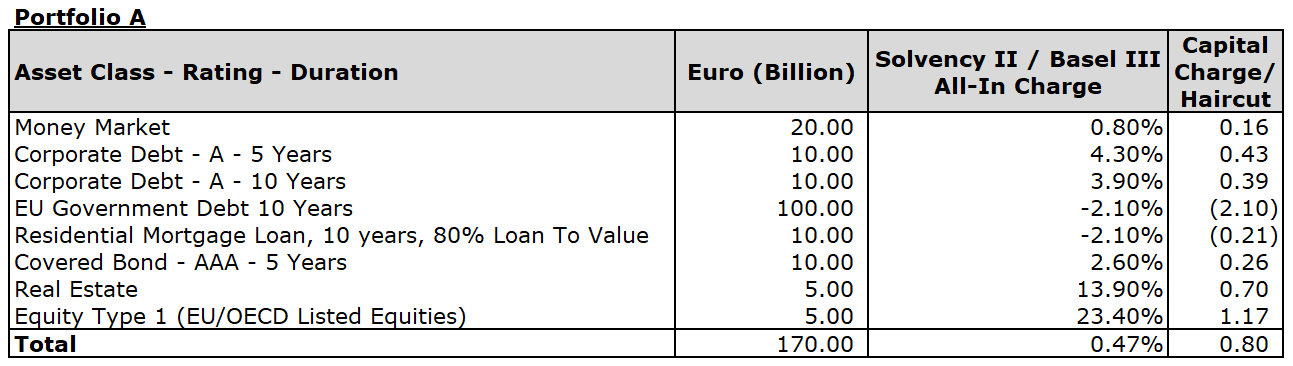

Now, for reference, here is a sample Capital Charge/Haircut table. For simplicity sake, we assume that the Capital Charge/Haircuts are the same for both the Bank and Insurance Company.

Now, a "Standalone Charge", is the Charge for the asset class on its own, while the "All-In Charge" includes other factors such as diversification and duration matching which should theoretically bring down risk, which is why its slightly lower.

Now one thing you will find very interesting here, is that EU Government Debt, or Sovereign Debt actually have a negative All-In Charge, which gives rise to the distortion.

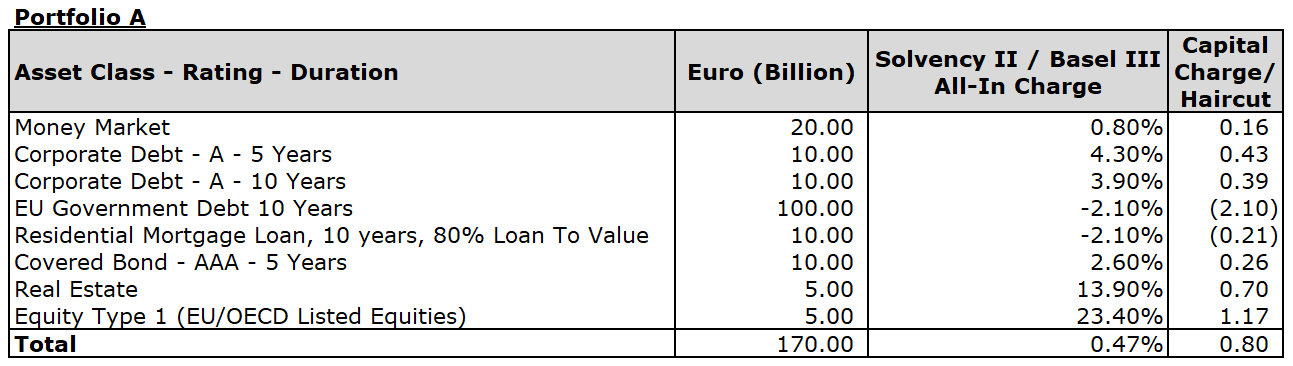

To illustrate, lets use the following example. For our example, we will be using the All-In Charge figures.

Now "Baka-Surance Bank" holds a portfolio as above, and when calculating Solvency or Liquidity, its asset amounted to ("Original Asset Value" Less "Capital Charge/Haircut"), (EUR170 Billion less EUR0.8 Billion) EUR 169.2 Billion.

Now, after reviewing their portfolio, it noted that all of its "EU Government Debt 10 Years" are negative yielding. By investing money into these bonds, they are basically guaranteeing that they will lose money.

As the sovereign debt trades to a negative yield, it would be wise to sell it in order to hold cash.

Selling the debt would increase Baka-Surance Bank's liquidity, raise its portfolio’s return, lower duration risk, reduce market risk, and even reduce credit risk, as government debt can default.

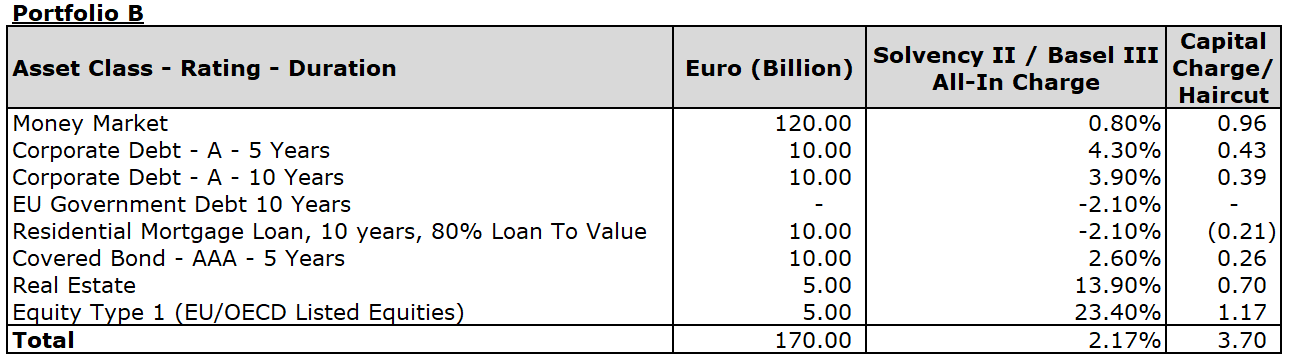

Baka-Surance Bank therefore decided to sell all of it and to the "Money Market" ie, they basically chose to hold cash instead.

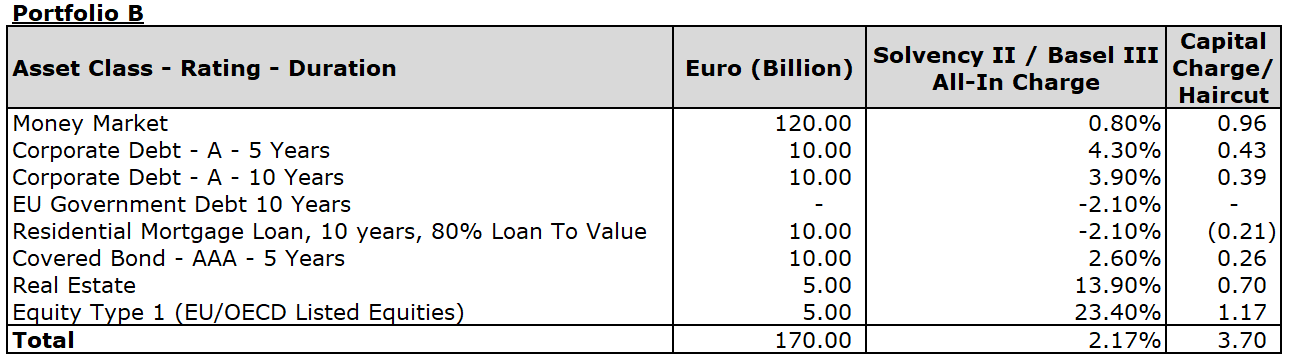

After the portfolio readjustment, the Portfolio now looks like this.

However, if they did this, the Capital Charge/Haircut is now EUR 3.7 Billion, having increased from EUR 0.8 Billion

When calculating Solvency or Liquidity, Baka-Surance Bank's asset now amounted to EUR 166.3 Billion, which is now lower than when it previously held negative yielding sovereign debt (EUR169.2 Billion).

From this, you can see how Basel III and Solvency II practically forces Bank and Insurance Companies to hold sovereign debt.

Hot Potatoes and what does this mean?

And so, we now have the question.

As governments around the world continue to borrow money to fund ever-escalating budget deficits, and Banks/Insurance Companies are constantly incentivized to keep purchasing these Sovereign Bonds.

Given the size of the persistent deficits of these nations and the size of their hidden liabilities (17 Nobel Laurates on USD200 Trillion Deficit), which over time will inevitably result in the inability of a nation to pay its debts, and require debt forgiveness.

Well, governments around the world today are bailing out the public by selling the future and devaluing their own currency. (By printing money, you basically reduce the value off all the currencies already in the market, ie the value of everyone's cash drops a little.)

Who will bail the bailors?

Where can these Government go for bailouts when its their turn?

Is it even possible to bail out a government?

At one point does an entity becomes too big to bail? What happens next?

Just how much more Malaysian Government Securities can EPF and PNB continue to buy?

And if inflation happens, could we even increase interest rates with worldwide debt at an all time high?

Well, these are questions so big, that i have no idea how to answer it.

There are some topics (like this one) so complex and opaque, that one needs to be highly educated and well versed in the subject, in order to be unclear about the conclusions and be unable to come to an opinion.

“There are decades where nothing happens, and there are weeks where decades happen.” — Vladimir Lenin

I have a feeling that everything will just keep chugging along, until that one moment when we cross the Rubicon, and everything happens all at once.

Fun times are ahead somewhere.

And those young enough are may be to be lucky enough to see the answer to the question above.

参考来源

For a copy with better formatting, go here, its alot easier on the eyes.

Hot Potatoes (Hidden Structural Risks in Insurance Companies and Banks)

========================================================================

Here is an interesting statistic.

Across the world, out of the 196 countries in the world, only around 50 or less countries run a budget surplus or balanced budget, ie the country's revenue exceed/equal its expenses consistently.

The rest of the world runs on a deficit and needs to borrow money in order to cover the shortfall in government revenue.

And out of the 50 or less countries that balance their budgets or have surpluses, the significant economies (large enough) are,

Macau

Hong Kong

Norway

Singapore

Jamaica

South Korea

Sweden

Iceland

Bulgaria

New Zealand

Germany

Berlarus

Luxembourg

Netherlands

Czechia

Uzbekistan

Switzerland

Taiwan

Combined, these countries barely consist of 10% of global GDP. In addition, their total surpluses also does not exceed even 3% of the total deficits of the rest of the countries.

And thus the question, who are the ones borrowing money to these countries?

Enabling them spend far beyond their means, and allowing huge fixed costs to build up in economies around the world.

Well, allow me to introduce you to "Basel III" (New Regulation for Banks since 2009) and "Solvency II" (New Regulations for Insurance Companies since 2009).

Both of these two regulations were given rise via directives from the European Union after the 2008 Great Financial Crisis and subsequently adopted worldwide.

Banks (Basel III)

For banks, Under the new Basel III regulations, there is something called the Liquidity Coverage Ratio, which requires banks to maintain lots of very safe liquid assets like government bonds to cover funding stress.

This ratio also categorizes certain deposits as “non‐operating” and assigns them punitive haircuts when calculating the ratio.

These deposits include deposits received from the retail market, Which includes fixed deposits or current accounts placed by individuals or companies.

In response to these regulations, banks are therefore incentivized to purchase and hold sovereign debt sold by all these countries running fiscal deficits, while looking for loopholes enabling them to more profitably carry these non‐operating deposits.

These methods include:

Asking customers to switch unwanted deposits into sovereign bonds the bank can hold in custody

Asking customers to take out loans to buy sovereign bonds and replace the cash.

Asking customers to transact through off‐balance sheet derivatives such as

swaps

Asking customers to replace physical cash positions with synthetic look‐alikes, collateralized with sovereign bonds.

All of which drives up the demand for sovereign bonds.

Insurance Companies (Solvency II)

The Insurance Companies are also under a similar situation when it comes to their Portfolio they hold and the Capital Charges/Haircuts required for each asset class in order to calculate Solvency Ratios.

Now, its probably not that easy to imagine the above scenarios, so lets put some numbers to it.

Illustrating Distortions cased by Basel III and Solvency II

Imagine a Bank/Insurance Company, lets call it "Baka-Surance Bank".

Now, for reference, here is a sample Capital Charge/Haircut table. For simplicity sake, we assume that the Capital Charge/Haircuts are the same for both the Bank and Insurance Company.

Now, a "Standalone Charge", is the Charge for the asset class on its own, while the "All-In Charge" includes other factors such as diversification and duration matching which should theoretically bring down risk, which is why its slightly lower.

Now one thing you will find very interesting here, is that EU Government Debt, or Sovereign Debt actually have a negative All-In Charge, which gives rise to the distortion.

To illustrate, lets use the following example. For our example, we will be using the All-In Charge figures.

Now "Baka-Surance Bank" holds a portfolio as above, and when calculating Solvency or Liquidity, its asset amounted to ("Original Asset Value" Less "Capital Charge/Haircut"), (EUR170 Billion less EUR0.8 Billion) EUR 169.2 Billion.

Now, after reviewing their portfolio, it noted that all of its "EU Government Debt 10 Years" are negative yielding. By investing money into these bonds, they are basically guaranteeing that they will lose money.

As the sovereign debt trades to a negative yield, it would be wise to sell it in order to hold cash.

Selling the debt would increase Baka-Surance Bank's liquidity, raise its portfolio’s return, lower duration risk, reduce market risk, and even reduce credit risk, as government debt can default.

Baka-Surance Bank therefore decided to sell all of it and to the "Money Market" ie, they basically chose to hold cash instead.

After the portfolio readjustment, the Portfolio now looks like this.

However, if they did this, the Capital Charge/Haircut is now EUR 3.7 Billion, having increased from EUR 0.8 Billion

When calculating Solvency or Liquidity, Baka-Surance Bank's asset now amounted to EUR 166.3 Billion, which is now lower than when it previously held negative yielding sovereign debt (EUR169.2 Billion).

From this, you can see how Basel III and Solvency II practically forces Bank and Insurance Companies to hold sovereign debt.

Hot Potatoes and what does this mean?

And so, we now have the question.

As governments around the world continue to borrow money to fund ever-escalating budget deficits, and Banks/Insurance Companies are constantly incentivized to keep purchasing these Sovereign Bonds.

Given the size of the persistent deficits of these nations and the size of their hidden liabilities (17 Nobel Laurates on USD200 Trillion Deficit), which over time will inevitably result in the inability of a nation to pay its debts, and require debt forgiveness.

Well, governments around the world today are bailing out the public by selling the future and devaluing their own currency. (By printing money, you basically reduce the value off all the currencies already in the market, ie the value of everyone's cash drops a little.)

Who will bail the bailors?

Where can these Government go for bailouts when its their turn?

Is it even possible to bail out a government?

At one point does an entity becomes too big to bail? What happens next?

Just how much more Malaysian Government Securities can EPF and PNB continue to buy?

And if inflation happens, could we even increase interest rates with worldwide debt at an all time high?

Well, these are questions so big, that i have no idea how to answer it.

There are some topics (like this one) so complex and opaque, that one needs to be highly educated and well versed in the subject, in order to be unclear about the conclusions and be unable to come to an opinion.

“There are decades where nothing happens, and there are weeks where decades happen.” — Vladimir Lenin

I have a feeling that everything will just keep chugging along, until that one moment when we cross the Rubicon, and everything happens all at once.

Fun times are ahead somewhere.

And those young enough are may be to be lucky enough to see the answer to the question above.

Conclusion

Here's an interesting question.

If cash is trash, bonds are shit and inflation (supply side or demand side, well probably combination of both) is coming.

What do you hold?

Commodities or stocks?

Gold or Google?

What about deflation?

If COVID 19 persists, and continues to kill demand and supply for the next 5 years or so, what do you hold then?

Disclaimers: Refer here.

====================================================================

Facebook: Choivo Capital

Website: www.choivocapital.com

Email: choivocapital@gmail.com

Here's an interesting question.

If cash is trash, bonds are shit and inflation (supply side or demand side, well probably combination of both) is coming.

What do you hold?

Commodities or stocks?

Gold or Google?

What about deflation?

If COVID 19 persists, and continues to kill demand and supply for the next 5 years or so, what do you hold then?

Disclaimers: Refer here.

====================================================================

Facebook: Choivo Capital

Website: www.choivocapital.com

Email: choivocapital@gmail.com

参考来源